Table of Contents

It began with a promise and escalated into economic upheaval. In early 2025, President Donald Trump reignited a trade war with China, aiming to address longstanding trade imbalances and perceived unfair practices. “Trade wars are good, and easy to win,” he had once tweeted. But the ensuing months revealed a complex web of retaliations, market volatility, and global economic strain.

The Logic Behind the War

President Trump’s rationale centered on reducing the U.S. trade deficit with China and combating intellectual property theft. By imposing tariffs, he intended to encourage domestic manufacturing and pressure China into fairer trade practices.

The Fire Ignites: February & March Updates

- February 1: The U.S. imposed a 10% tariff on Chinese imports.

- February 4: China retaliated with a 15% tariff on U.S. coal and LNG, and 10% on crude oil and agricultural machinery.

- March 3: The U.S. increased tariffs by another 10%, totaling 20%, and added 25% tariffs on imports from Mexico and Canada.

- March 4: China responded with a 15% tariff on U.S. agricultural products, effective March 10.

April Escalation: A Trade War Unleashed

- April 2: President Trump announced a 34% tariff increase on Chinese goods, citing China’s 67% trade barriers.

- April 4: China declared a 34% tariff on all U.S. goods, effective April 10.

- April 7: Trump threatened an additional 50% tariff if China didn’t withdraw its retaliatory measures.

- April 9: The U.S. raised tariffs to 125% on Chinese goods; China responded with 84% tariffs on U.S. goods.

- April 11: The U.S. clarified tariffs had risen to 145%; China increased its tariffs to 125% on April 12.

- April 16: The US increases the tariff to 245% tariff on China.

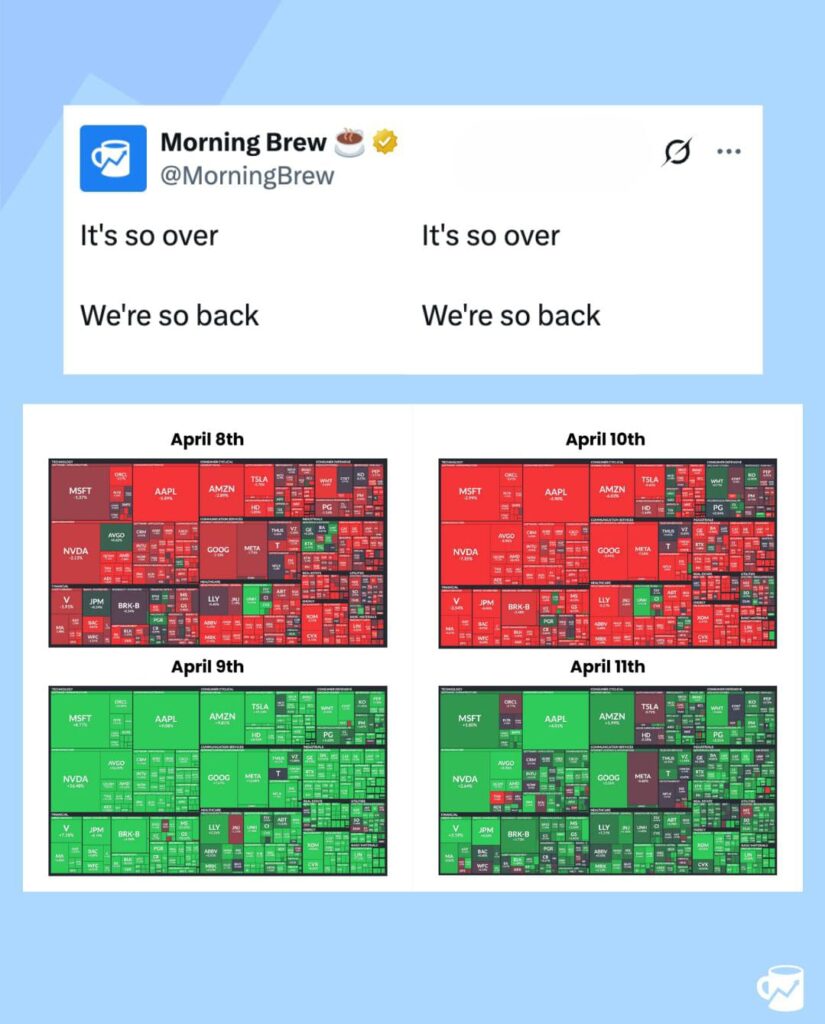

Market Reactions: Volatility and Uncertainty

The markets responded with significant volatility. Investors shifted away from U.S. stocks and the dollar, seeking safe-haven assets like gold, which surged to a record $3,300 per ounce. The dollar has depreciated nearly 10% since January, reflecting eroding confidence in U.S. economic leadership.

China’s Strategic Countermeasures

China employed several tactics in response:

- Rare Earth Export Controls: On April 4, China restricted exports of rare earth elements, crucial for electronics and defense industries.

- Boeing Ban: China halted imports of Boeing aircraft and U.S. parts, impacting the aerospace sector.

- Consumer Campaigns: Chinese social media campaigns encouraged consumers to buy local, exposing U.S. luxury brands and promoting domestic alternatives.

Global Impact: A Decoupling of Economies

The World Trade Organization projected an 80% drop in U.S.-China merchandise trade for the year, signaling a shift towards two separate global trade blocs. This decoupling is expected to depress global economic growth, with 2025 GDP forecasts lowered to 2.2%.

India’s Position: Opportunities and Challenges

India identified ten sectors, including apparel, chemicals, and pharmaceuticals, where high U.S. tariffs on China provided a competitive edge. However, the sudden shift in trade dynamics posed challenges for Indian exporters, who struggled to match China’s scale and efficiency.

The Fallout: Big Players Bend, Small Players Break

As the 2025 tariff war barrels forward, one thing is painfully clear: big businesses maneuvered, but small businesses absorbed the shock. Apple flew in iPhones on private jets before tariffs hit. Walmart negotiated exemptions. Boeing braced for the Chinese cold shoulder with global reserves. But the corner fabricator in Ohio? The solar panel startup in Bengaluru? The niche leather exporter in Tamil Nadu? They bled.

Global trade is no longer just about goods—it’s about power, politics, and perception. What was once a finely balanced ecosystem has become a battleground of economic nationalism. Trump’s tariffs may yet force China to the negotiating table—but at what cost?

For founders, this war isn’t an abstract policy—it’s supply chain delays, exploding costs, lost contracts, and sleepless nights. The message is sobering: in a world ruled by tariffs and tweets, resilience isn’t optional—it’s existential.

And as the dust settles, one question hangs in the air: Who really wins a war where everyone is paying?